Recovery for All

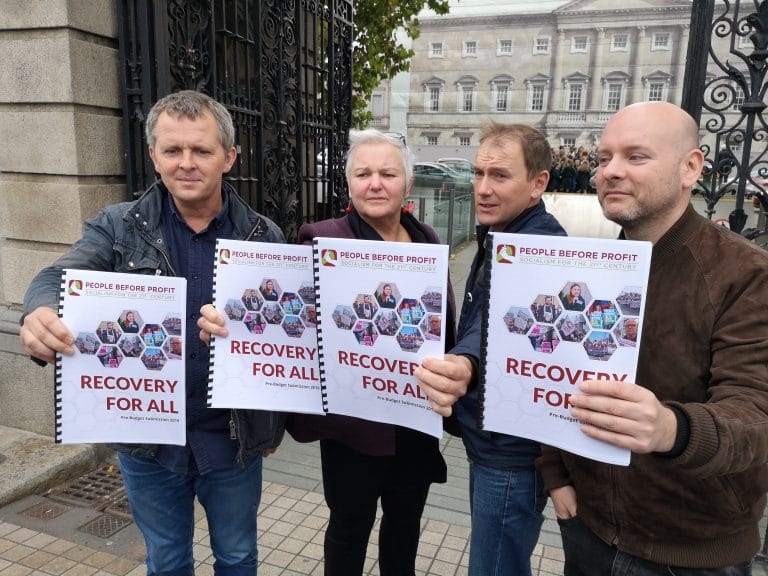

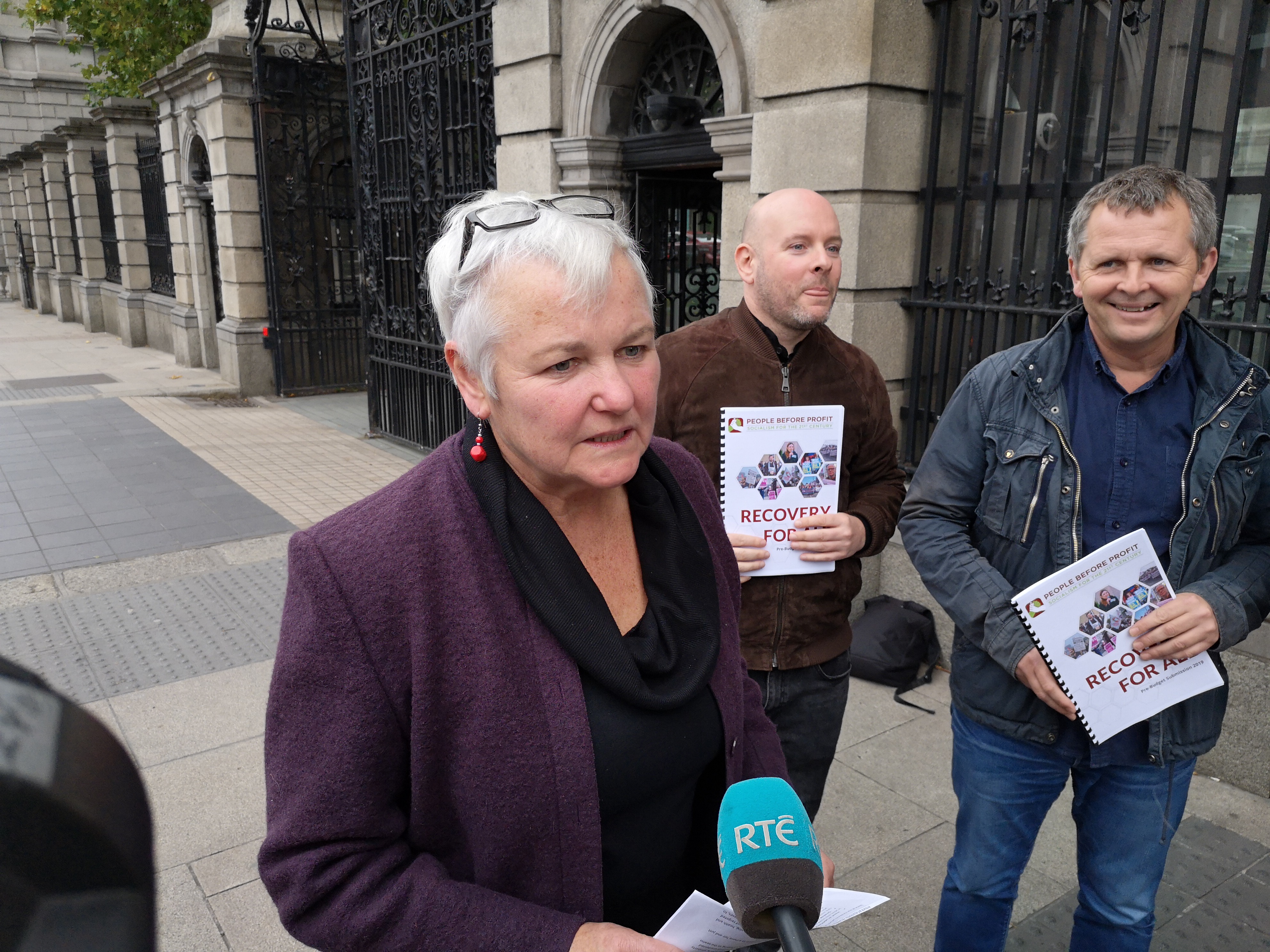

People Before Profit launch Alternative Budget Statement

At the press conference today in Dublin, People Before Profit launched their Alternative Budget proposal-Recovery for All, in which they outlined their vision for a fairer and more equal society and the budgetary measures that could make it happen.

The Fine Gael economic model has seen a spectacular recovery in profits for corporations, property speculators and the super wealthy in a society while at the same time creating an unprecedented housing and homelessness crisis, a health service and infrastructure which is creaking at the seams and a culture of low paid precarious work for many workers.

A Recovery for All looks to set out a pathway by which Ireland can transition to a more fair and just society with wealth distribution and human rights being delivered for all.

In the document, People Before Profit propose radical measures to address the housing, health and infrastructure crises and achieve real economic equality, to be paid for through a series of targeted measures directed at making corporations and the super wealthy paying their fair share of taxes, to ensure an economic recovery that genuinely benefits all.

Some of the measures which are proposed in the document are:

- Invest an additional €2.9 billion to build public and affordable housing on public land– in 2019, this would provide 21,000 extra homes.

- Develop a National Healthcare System-provide €3 billion next year to roll out Free GP care, create an extra 1,000 hospital beds, abolish all out of pocket charges and roll out free primary care facilities across the state. We would also spend an extra €304 million on mental health.

- Make public transport free-This is an essential step to reduce C02 emissions and reduce traffic congestion. This would follow countries like Estonia who have moved to free public transport – cost €580 million

- Tax Justice for Workers– By taxing corporations and millionaire households we can scrap the Universal Social Charge and the Local Property tax

- Reverse all FEMPI cuts and re-establish full pay equality for public sector workers.

– Social Welfare– Increase all social welfare by €10 per week, abolish discriminatory JSA rates for u26s and introduce a universal state pension of €250 per week from age 65.

- Reinvigorate Rural Ireland– In government we would spend €500 million on rural broadband, an extra €93 million on rural development and €250 million on a Western rail corridor.

- Renewable Energy– we would invest an extra €750 million on renewable energy and €250 million on agri-environmental initiatives.

Key Tax & Revenue raising measures:

*A minimum effective corporation tax rate – €7.1 billion

*Tax On-shoring IP – €721 million

*3 new bands of income tax on highest earners – over 100,000, over 150,000, over 200,000 – €2.1 billion

*Increase the top rate of employers PRSI by 2% – €1.4 billion

*Introduce a Financial Transaction Tax – €219 million

*Introduce an Idle Site Value and Empty property Tax – €187 million

*Introduce a millionaires wealth tax

*Remove reduced VAT rate in the Tourism & Hospitality sector €490 million

People Before Profit economics advisor Brian O’Boyle said: “Ireland is a tax haven. We have an incredibly wealthy society with corporations making unbelievable profits and availing of loopholes in the tax system to sidestep our headline corporation tax rate of 12.5%.

“The Comptroller and Auditor General confirmed that the very richest people in the state are paying hardly any taxes. A quarter of those with wealth of over €50 million paid less than an average PAYE worker, with a further 40 paying less than €120,000. He also identified €219 billion worth of profits that will not be taxed because of tax loop-holes in the form of losses forward and allowances. The conclusion of this is that the corporations and the wealthiest in our society have to pay their fair share.”

Richard Boyd Barrett TD said: “Economic recovery under Fine Gael has been stunning success for the corporations, property speculators and very wealthy, who have seen a staggering rise in profits and wealth but it has been done at the expense of a diabolical housing emergency, a crumbling public health system, major infrastructural crises and a widespread culture of low-paid and precarious work.

“The most serious and complete of Fine Gael’s failures is the housing emergency – a crisis seven years in the making that now threatens to overwhelm our society and the economy. Not only have we the obscenity of over 10,000 people and 4,000 children in homelessness but we know also have a whole generation of young people and workers completely without any prospect of ever having a secure and affordable roof over their head. This is not an accident but rather the consequence of a deliberate policy. The government have promoted developers and vulture funds to buy land and property off NAMA and the banks, which the public owned, for a song, and allowing them to speculate and hoard as prices and rents soar.

“What we are proposing is a radical shift in policy by directly providing 21,000 public and affordable houses in 2019 and similar numbers in the following years, as part of a dramatic shift away from reliance on the private sector and towards a policy of large-scale of construction of public and affordable housing on public land. Housing is a human right and collectively our policies would increase the social and affordable housing stock in 2019 by roughly 21,000 units and continue over the following years to eliminate housing waiting lists, altogether. This would relieve pressure on rent, house prices and land values across the state. There will also be an enormous medium to long-term saving for the state as HAP, Ras and leasing costs are reduced, which are set to rise dramatically under the failed and misguided Re-building Ireland plan.”

Bríd Smith TD said: “The government keep telling us that everything is rosy in the garden and that we are in a recovery. But workers are still being told that they have to wait. Fine Gael claim they are ready to restore pay to the 60,000 post 2011 entrants, but they only put up €27 million of €200 million that is needed. Beyond this, they made no mention of FEMPI which is costing public sector workers billions.

“We believe that workers should share in the recovery that they have worked so hard for. We introduce real pay equality and we would immediately scrap FEMPI which has seen a crisis for workers such as nurses and teachers who are leaving this country in their droves because of the cost of rent, the cost of living and the conditions of employment, particularly in the health service.

“On the environment, Ireland is risking fines of up to €600 million every year because, as the Taosieach himself said, we are being seen as laggards in our contribution to Co2 emissions. We want to increase investment in 5,000 green jobs over a five year plan. We want to move away from the reliance on Spruce trees and implement a massive investment in afforestation. We also want a €400 million investment in water infrastructure.”

Gino Kenny TD said: “We have a totally different vision for the Irish Healthcare system than that which Fine Gael are presiding over. We would increase investment in services and begin a move towards a One-Tier healthcare system. We want a National Health Service that is available to everyone that is not based on the size of your wallet. We propose opening 1,000 beds in acute hospitals, employing 500 extra consultants to bring us up to the EU average and employ an extra 4,000 nurses amongst a suite of other measures.

“We would also introduce a Universal Free GP card, a massive expansion in services for people living with a disability and bring mental health spending in line with A Vision for Change.

“Only through an ambitious budget which priorities people ahead of the wealth and profits of a few can we have a fair and just society for all.”

Links: https://www.rte.ie/news/budget-2019/2018/1008/1001711-budget/